Contents:

A GMROI ratio higher than 1 means you’re promoting stock at a worth greater than the price of buying it. A greater GMROI indicates greater profitability and elevated inventory efficiency. BoxFox lets you quickly recover cash for aged stock and instantly put that money toward better promoting products. We present a calculator under that helps you apply this to your business. GMROI is expressed as a percentage or a rupees multiple, telling you how many times you’ve gotten your original inventory investment back during a specified period.

New product training to store staff to enhance their selling skills. Ensuring minimal store expenses to balance profit & loss statement for a particular store. Monthly target achievement by 120% to manage best perk level at the store. Trend analysis to select right product as per market demand and to reduce the competition.

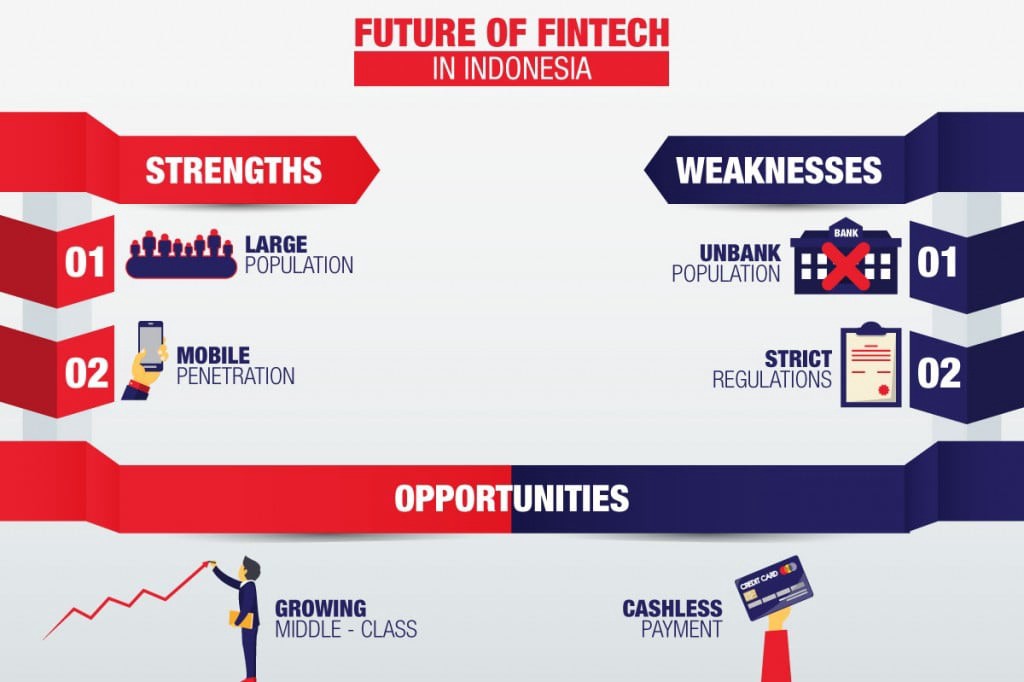

Divide the sales by the average cost of inventory and multiply that sum by the gross margin percentage to get GMROI. The result is a ratio indicating the inventory investment ‘s return on gross margin. The gross margin return on funding is a listing profitability evaluation ratio that analyzes a agency’s capability to turn stock into cash above the price of the stock. This course is designed for retail owners, senior management personnel in retail industry and key decision makers. It is also for senior personnel of general merchandise management, operations management, marketing, finance, human resources and management information system. This tool is also useful for various service providers and vendors to retail industry.

Just with simple and systematic improvements in inventory movements, retails are able to eliminate waste, rotate unused stocks, and improve business’s return on assets. For example, inventory needs to be built up for the new stores that we plan to open. We will concentrate on opening stores on time so that we don’t block our funds.

Argos, Time Zone and Nuance joint ventures are the new initiatives taken by the group. By FY10, the company aims to open 49 department stores, 20 value retailing stores and 251 specialty-retailing outlets. However, the store roll-out is behind schedule by two-three quarters due to a delay at the real estate developer’s end. Shopper’s Stop and Home Stop will be categorised under the lifestyle format while Hypercity will be part of the value-retailing format. New Gross Margin Return On Investment, or GMROI, is likely one of the most essential profitability metrics in retail.

To be ready with presentation to seniors for strategy plan and to get the required approvals from senior management. The regional distribution centres are connected online to the central systems. It also ensures that the required goods are always available for customers. In FY07, the chain level sale per square feet increased 5% from Rs 7,576 psf to Rs 7,973 psf. Customer footfall went up 10% but the conversion ratio remains unchanged at 27%. Calculate the gross margin of the item—or the web sale of goods minus the cost of items bought.

Ed-a-Mamma – Retail Planner (5-8 yrs),Mumbai, Maharashtra, India

Advanced analytical tools must be employed to know what’s there on the customer’s priority list. The retailers must identify their most profitable products according to the seasons, and demographic details of the customers. After making a clear classification of most profitable and least contributing items, the business owners must shift the focus on their performance. One must reduce the investment and time on those items that are less preferred by the customer or the area that contributes towards the minimum sale resulting in the least profitability of the business.

The price of products sold valuation is the amount of products sold occasions the Weighted Average Cost per Unit. There are different ways in which a retailer can estimate its return on investment. The investment can be in the form of capital invested on inventory, labour, rent, IT tool employed etc. in your retail store.

GMROF stands for the Gross Margin Return on Footage and measures the inventory productivity by expressing the relationship between the Retailers gross margin and the area allocated to the inventory. GMROF is generally expressed as a percentage, and it gives the retailers an idea of how much returns they’ve gotten per area during a specified period of time. The store’s design is a key factor in deciding, customer’s movability across various departments and the order of picking desired items in the shopping cart. The retailers must be well aware of the most profitable locations in the store and shelves at those locations must be arranged with fast moving products that catch the attention of customers. Considerable attention to lighting, mirror position, and trial room settings can also boost the sale significantly. A planned store layout is not only helpful in optimising the per square foot space of the store, but, also result in enhancing the customer’s in-store experience.

TOT decisions with vendors and amendment if required as per business requirements. Planning for seasonal merchandise to get the desired targets for the period with margins. Vendor management to keep the optimal stock level in range and promo/seasonal articles. Highest sales achieved in Luggage during SS6D 2013 (159% of the target). Cleanliness of store area to give complete hygiene feel to customer.

In some cases, GMROI is multiplied by a hundred, which with this example would go away GMROI at a price of 166. This formula is often used by retailers to evaluate their inventory inventory and value. A GMROI ratio above 1.00 is a sign that a company is promoting their stock at the next value than it price; and is making revenue on that stock. Now, you’ll be able to calculate the inventory turnover ratio by dividing the price of items sold by average stock.

Since sales and stock levels often fluctuate throughout a yr, the 40 days is an average from a earlier time. To calculate your inventory turnover ratio, you have to know your cost of products sold , and your average inventory . Inventory turnover is an particularly necessary piece of information for maximizing efficiency within the sale of perishable and different time-delicate items. Some examples could possibly be milk, eggs, produce, fast style, cars, and periodicals. The accounts turnover ratio is calculated by dividing whole web gross sales by the common accounts receivable steadiness.

Go for an Appropriate Store layout

The average assortment period is the amount of time it takes for a enterprise to receive funds owed by its purchasers by way of accounts receivable . Companies calculate the typical assortment period to ensure they’ve enough cash available to satisfy their monetary obligations. GMROF stands for Gross Margin Return On Footage – a measure of inventory productivity that expresses the relationship between your gross margin, and the area allotted to the inventory.

We have identified around 30 cities and towns, which have the potential to support Shopper’s Stop, and Hypercity formats. The major cities in the country account for more than 65% of the consumption relevant to our formats. We have consciously restricted ourselves from spreading ourselves too thin, which could result in undesirable unprofitable growth.

He’s on a mission to solve business challenges through innovation in ERP solution suites. Delivered highest sales ever for khan market store which was a 6 year old in 2012. Assortment planning for the stores & zone as whole in accordance to the Top line & Bottom line Targets. Merchandise planning of the stores in accordance to the NM% planned. Optimal stock levels at the stores – Coordinating with store, DC team & Vendors.

- To that extent, we might lose market share, but we would rather have sustained profitable growth rather than bad growth.

- We present a calculator under that helps you apply this to your business.

- The retailers must identify their most profitable products according to the seasons, and demographic details of the customers.

- Companies calculate the typical assortment period to ensure they’ve enough cash available to satisfy their monetary obligations.

- Shopper’s Stop and Home Stop will be categorised under the lifestyle format while Hypercity will be part of the value-retailing format.

- Vendor management to keep the optimal stock level in range and promo/seasonal articles.

An overabundance of cashmere sweaters might lead to unsold stock and misplaced earnings, especially as seasons change and retailers restock with new, seasonal stock. The average balance of accounts receivable is calculated by adding the opening steadiness in accounts receivable and ending steadiness in accounts receivable and dividing that whole by two. When calculating the common assortment interval for an entire year, 365 could also be used as the variety of days in one year for simplicity. Most of the retail business work in design-to-consumer scenario and find hard to balance between long production lead times with constantly shifting consumer demands in the stipulated time frame.

[[ employer.company_name ]] Office and Product Photos

In the instance above, $10,000 in initial dead stock cost was offered on BoxFox. The proprietor put that cash to work buying new inventory and multiplied their return on funding. The $6,500 instantly recovered on BoxFox bought new stock that generated $45,360 in gross revenue for the enterprise.

It measures how productively you’re turning inventory into gross profit. A higher GMROI indicates greater profitability and increased inventory efficiency. Tools such as GMROF is essential for Retailers since this can help them identify the profit generating areas within their Retail stores. Hence, Retailers are now able to make more efficient and planned out decisions regarding the increasing or decreasing allocation of categories within the store. Space productivity is critical for successful retailing and GMROF is the tool that allows Retailers to measure it and make changes accordingly. Crossword, Mothercare and the food and beverage brands (Desi café, Brio) will fall under specialty formats.

Consequently, revenues can be upwards of Rs 30-40,000 psf against Rs 10-15,000 psf in a department store. Because of the high stock turns, the investment in inventory is considerably low. Though goods are exempt from import duty, there is lack of clarity on sales tax and service tax. Our two formats — Stop and Go — are already operational at the Mumbai airport. The primary means of earning a profit for a Retailer is via their inventory investment. But in order to do this efficiently, Retailers require tools such as GMROF to help them analyze.

Inventory turnover is a ratio displaying how many instances an organization has sold and changed stock during a given interval. A company can then divide the days within the period by the stock turnover method to calculate the days it takes to sell the inventory readily available. Calculating inventory turnover might help companies make better choices on pricing, manufacturing, advertising and purchasing new inventory.

gmrof turnover, or the variety of times inventory is sold over a given interval, affects profitability. Keeping stocks which might be out of date and have a low turnover slows down sales. Inventory levels should consider demand levels to keep away from overstocking and under stocking. Proper inventory administration is significant to maximizing operational effectivity and profitability.

An total lower in inventory price results in a lower price of goods sold. With all different accounts being equal, an even bigger gross profit can translate into higher profits. It takes Cost of Goods Available for Sale and divides it by the number of units out there for sale (variety of items from Beginning Inventory + Purchases/manufacturing).

It measures how productively you are turning inventory into gross profit. A bodily rely is then carried out on the ending stock to determine the number of items left. Finally, this quantity is multiplied by Weighted Average Cost per Unit to provide an estimate of ending stock cost.

24 years old Early Childhood (Pre-Primary School) Teacher Charlie from Cold Lake, has several hobbies and interests including music-keyboard, forex, investment, bitcoin, cryptocurrency and butterfly watching. Is quite excited in particular about touring Durham Castle and Cathedral. GMROF is expressed as a percentage or a rupees multiple, telling you how much returns you’ve gotten from each piece of full time employee during a specified period.

GMROI demonstrates whether a retailer can make a revenue on their stock. As in the above example, GMROI is calculated by dividing the gross margin by the inventory price. The gross margin return on investment is an inventory profitability evaluation ratio that analyzes a firm’s ability to turn inventory into cash above the cost of the inventory. It is calculated by dividing the gross margin by the average inventory cost and is used often in the retail industry. Keep in thoughts that gross margin is the net sale of goods minus the price of goods offered. An alternative methodology consists of utilizing the price of items bought as a substitute of gross sales.

Analysts divide COGS by common inventory as an alternative of sales for larger accuracy in the inventory turnover calculation as a result of sales include a markup over cost. In both situations, average stock is used to assist take away seasonality effects. Inventory turns measures the variety of instances stock is offered or utilized in a strictly defined time period. Using 360 because the number of days in the yr, the corporate’s days’ sales in stock was forty days .