L'articolo What is bookkeeping? Definition, types, and best practices proviene da Ebike Italia.

]]>Content

- What are common bookkeeping mistakes?

- Best Bookkeeping Services

- Double-entry bookkeeping

- Full-Time Bookkeeping for Small to Medium Businesses

- Handle Accounts Payable

- How Much Should You Be Paying for Bookkeeping Each Month?

While they seem similar at first glance, bookkeeping and accounting are two very different mediums. Bookkeeping serves as more of a preliminary function through the straightforward recording and organizing of financial information. Accounting takes that information and expands on it through analyzing and interpreting the data. There is a subtext here that we haven’t yet discussed and it’s important that we do. Because while every task the bookkeeping service completes is vital to the financial health of your business, it’s the underlying structure they apply that really makes a difference.

When an effective bookkeeping system is in place, businesses have the knowledge and information that allows them to make the best financial decisions. Tasks, such as establishing a budget, planning for the next fiscal year and preparing for tax time, are easier when financial records are accurate. A full-charge bookkeeper can also manage payroll, handle deposits, create and maintain financial reports, manage the ever-changing world of sales taxes as well as quarterly taxes and withholding.

What are common bookkeeping mistakes?

In general, data entry and receipt sorting are a bookkeeper’s duties. They record all financial transactions in your general ledger utilizing double-entry bookkeeping. To some https://www.bookstime.com/ business owners, doing bookkeeping is probably their least favorite task. Even ones who are confident with bookkeeping, may simply not have enough time to handle the books.

There’s no one-size-fits-all answer to efficient bookkeeping, but there are universal standards. The following four bookkeeping practices can help you stay on top of your business finances. In these documents, transactions are recorded as a single entry rather than two separate entries. As a general rule, however, you’ll be offering from a fairly standard set of services. However, all of the things we’ve mentioned above don’t necessarily mean you need to outsource to a professional. While it sounds like hard work, it’s quite straightforward when you know what you’re doing.

Best Bookkeeping Services

By undertaking research and niching your services, you can begin to market yourself as an expert. Think about who your ideal client would be and what type of work you’d do for them. We created service bundles and marketed them, then reacted to what customers said.

Many of the operations are automated in the software, making it easy to get accurate debits and credits entered. Bookkeeping tasks provide the records necessary to understand a business’s finances as well as recognize any monetary issues that may need to be addressed. Proper planning and scheduling is key since staying on top of records on a weekly or monthly basis will provide a clear overview of an organization’s financial health. Assets are all the resources and cash owned by the company, such as inventory. Expenses are cash from the company to pay for items, such as salaries and utilities. We start with your current accounting system and build up, so you can avoid costly and unnecessary software transitions.

Double-entry bookkeeping

For full time services, expect to pay from $3,000 to $4,500 per month without the benefits. For outsourced bookkeeping, the price is from $500 to $2,500 per month for basic bookkeeping tasks. Many small business owners in Cary view bookkeeping and accounting as two different services that work together. Bookkeeping consists of creating and maintaining an organization’s financial records.

- For full time services, expect to pay from $3,000 to $4,500 per month without the benefits.

- Because every client and their needs vary so widely, we provide flexible, unique pricing for every client.

- With this method, bookkeepers record transactions under expense or income.

- Business owners who wish to automate their financial tasks can use some of the latest tools on the market.

- A downside of Bench is that it specializes in cash-basis accounting, although there is a custom accrual accounting plan on the Pro plan.

Hiring a bookkeeping service is about more than just finding someone who can use a calculator and understand QuickBooks. You want a full-fledged team that has the professional background, training, and experience to really benefit your business. He or she creates your accounting data file so that it’s tailored to the specific needs of you and your business. He or she will ensure that you have access to the software and reports you need.

Full-Time Bookkeeping for Small to Medium Businesses

Intuit Inc. does not warrant that the material contained herein will continue to be accurate nor that it is completely free of errors when published. You may be hoping for the accounting and bookkeeping services for businesses best and have a few college courses in your back pocket. Even with these tools, you may not have the expertise you need to handle the responsibilities of a bookkeeper.

L'articolo What is bookkeeping? Definition, types, and best practices proviene da Ebike Italia.

]]>L'articolo What is POST? proviene da Ebike Italia.

]]>Content

- Music Hall

- The best time to post on Instagram

- POST

- Words Starting With P and Ending

- Post in your audience’s time zone, not yours

- posting noun

Posting is also used when a parent company maintains separate sets of books for each of its subsidiary companies. In this case, the accounting records for each subsidiary are essentially the same as subledgers, so the account totals from the subsidiaries are posted into those of the parent company. This may also be handled on a separate spreadsheet through a manual consolidation process. At the end of the accounting period, these items would be consolidated and posted into one line item in the general ledger.

“You would think that early mornings would tend to do better on LinkedIn, but we’ve found that our afternoon posts do sometimes blow up. While it used to be primarily professionals who are up and scrolling at 5 a.m., LinkedIn now has a lot of young professionals who are browsing in their leisurely time, too. Simply select your goal and Hootsuite will provide tailored recommendations for the best times to post. Guardian Music journalist Sean O’Hagan described post-punk as a “rebuttal” to the optimism of the 1960s personified by the Beatles, while author Doyle Green viewed it as an emergence of a kind of “progressive punk” music. Biographer Julián Palacios specifically pointed to the era’s “dark undercurrent”, citing examples such as Pink Floyd’s Syd Barrett, The Velvet Underground, Nico, The Doors, The Monks, The Godz, The 13th Floor Elevators and Love.

Music Hall

During the late 2010s and early 2020s, a new wave of UK and Irish post-punk bands gained popularity. Terms such as “crank wave” and “post-Brexit new wave” have been used to describe these bands. This scene is rooted in experimental post-punk and often features vocalists who “tend to talk more than they sing, reciting lyrics in an alternately disaffected or tightly wound voice”, and “sometimes it’s more like post-rock”.

In these cases, treatment is usually most effective when it addresses both the traumatic situation and the symptoms. People who have PTSD or who are exposed to trauma also may experience panic disorder, depression, substance use, or suicidal thoughts. Treatment for these conditions can help with recovery after trauma. Research shows that support from family and friends also can be an important part of recovery.

The best time to post on Instagram

The “For You” section shows you an endless stream of videos picked up by the algorithm, based on your past interaction on the app. Videos appearing in this section receive a wider audience and engagement. If you are also looking to boost your reach and engagement on TikTok, you ought to know the best time to post on TikTok.

It is usually used as a last resort, when all other attempts at service have failed. A method of publishing an ordinance by affixing it to the courthouse door. Assignment to a post, command, or particular location, especially in a military or governmental capacity. The Foundation to Combat Antisemitism monitors online incidents and postings of antisemitic hatred and propaganda. That was followed by a posting of the layoffs with the Arizona Department of Economic Security. Discover the myriad of artistic touches found throughout the property including sculptures, photography, architecture and of course, the artistry which mother nature has created all around us.

POST

It’s a stepping stone to help you get in the eye of your audience. As you move forward to find the best time to post on TikTok, you will realize that there is no single best day or time. Every brand has multiple what is posting occasions to find maximum exposure for their followers on TikTok. Since TikTok only provides you the post-performance data of the last 7 days, you must create a spreadsheet to track all your content performance.

What is a posting in accounting?

Posting in accounting is when the balances in subledgers and the general journal are shifted into the general ledger. Posting only transfers the total balance in a subledger into the general ledger, not the individual transactions in the subledger.

L'articolo What is POST? proviene da Ebike Italia.

]]>L'articolo The job market for bookkeepers in the United States proviene da Ebike Italia.

]]>This is supported by a McKinsey report suggesting that 61% of respondents believe capability-building programs only sometimes or rarely succeed in achieving “desired objectives and business impact”. Ultimately, your circumstance determines whether a bookkeeping certification would be worth it for you. Junior bookkeepers looking to establish themselves in the field are arguably more likely to benefit from certification.

Enrolling in one of the best online bookkeeping classes is a smart way for those interested in this career to bolster their existing financial knowledge. Some of the key tasks for accountants include tax return preparation, conducting routine reviews of various financial statements, and performing account analysis. Another key responsibility for accountants includes conducting routine audits to ensure that statements and the books are following ethical and industry standards. Whether it’s updating your books or keeping in contact with your tax adviser, maintain your business’s financial records and expenses throughout the year.

Hire Top Accountants…

After passing the AIPB’s certification exam, you will be recognized as a certified bookkeeper. A bookkeeping certification is an official demonstration of a person’s bookkeeping skills. It’s a way to show your skill set to potential employers and others in your professional network. You can earn a bookkeeping certification through a is bookkeeping in demand college, a university or an accredited professional program. About TaxBitTaxBit is the digital economy’s leading tax and accounting compliance solution designed by CPAs and tax attorneys. Our end-to-end platform, tailored for enterprises, financial institutions, and government bodies, streamlines compliance while ensuring accuracy.

- The Bureau of Labor Statistics predicts a steady job growth for accountants, making it a stable and promising career choice.

- Their job is to advocate and assist taxpayers when they have issues with the Internal Revenue Service.

- Additionally, maintaining a bookkeeping certification from NACPB or AIPB requires continuing professional development.

- Your general ledger should be up to date so that your bookkeeping software is able to provide functionality that you can navigate easily.

- Keeping up with the records in your small business might be a task you are willing and able to tackle yourself.

- Accountants analyze financial trends and provide companies with a strategy for maintaining their financial health.

Depending on the organization’s size, keeping track of business expenses and reconciling business statements may be your responsibility. In researching bookkeeping or bookkeeping accounting, you may come across information on accounting or find that bookkeeping and accounting are used interchangeably. While there is some overlap between bookkeeping and accounting, several factors distinguish these processes, as we explore in the table below. Financial institutions, investors, and the government need accurate bookkeeping accounting to make better lending and investing decisions. Bookkeeping accuracy and reliability are essential for businesses to succeed for staff, executives, customers, and partners.

How to Watch Godzilla x Kong: The New Empire – Showtimes and Streaming Status

You may determine if any payments are due, submit them, and record them in the financial ledger. As a bookkeeper, you may also receive client payments and deposit them at your company’s financial institution. There are dozens and dozens of bookkeeping options available and the choices may seem overwhelming. We’ve analyzed and rated the best online bookkeeping services to help you make the best decision when choosing the right one.

- It is important to possess sharp logic skills and big-picture problem-solving abilities, as well.

- Sonographer and home health licensed practical nurse are two other healthcare roles that made the top 10, for instance.

- Data from Indeed also showed that nearly 70% of Android developer roles were challenging to fill.

- NACPB also offers a Certified Public Bookkeeper license, which takes several months.

- As an aspiring accountant, have you considered the fusion of accounting with the robust analytical framework of STEM?

- Whether you’re trying to determine the best accounting system for your business, learn how to read a cash flow statement, or create a chart of accounts, QuickBooks can guide you down the right path.

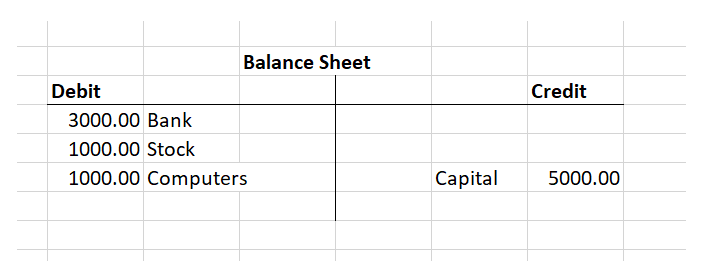

The two key reports that bookkeepers provide are the balance sheet and the income statement. The goal of both reports is to be easy to comprehend so that all readers can grasp how well the business is doing. Bookkeeping is the process of tracking and recording a business’s financial transactions. These business activities are recorded based on the company’s accounting principles and supporting documentation. When you think of bookkeeping, you may think it’s all just numbers and spreadsheets. Bookkeeping is the meticulous art of recording all financial transactions a business makes.

types of bookkeeping for small businesses

The following analysis compares the education requirements, skills required, typical starting salaries, and job outlooks for accounting and bookkeepers. Unlike certified public accountants, bookkeepers don’t file tax returns or audit financial statements. Unless they are a certified public accountant (CPA), bookkeepers should not prepare tax returns or sign the returns as a paid preparer. However, bookkeeping and accounting clerk jobs are expected to decline, with the BLS projecting a 5% fall in jobs over the same period. The BLS notes that job growth for accountants should track fairly closely with the broader economy.

That way, you can be well prepared when it’s time to file taxes with the IRS. Without any hiccups or last-minute scrambles, you’ll be able to enter tax season confidently. https://www.bookstime.com/ When it’s finally time to audit all of your transactions, bookkeepers can produce accurate reports that give an inside look into how your company delegated its capital.

L'articolo The job market for bookkeepers in the United States proviene da Ebike Italia.

]]>L'articolo Salary vs Wages: Know The Difference Between Wages and Salary proviene da Ebike Italia.

]]>Upper-level staff can also routinely receive fringe benefits, which are another key aspect of remuneration. These include such benefits as various types of health and life insurance, retirement payments, and care for children, as well as assistance in furthering education through tuition reimbursement. The term salary and wages is often confused by people and is used interchangeably. But the truth is that both these terms differ from each other and hold different meanings. There is also a difference between salary and wages in regard to the speed of payment. If a person is paid a salary, he is paid through and including the pay date, because it is very simple for the payroll staff to calculate his salary, which is a fixed rate of pay.

- Since wages are paid based on the hours spent doing the job and the work done, higher work hours mean you will get paid more.

- Salaries provide consistency with Fixed paychecks whereas Wages tend to fluctuate based on the number of hours worked.

- Learn more about the two types of pay and how employers determine which type their employees recieve.

- Compensation for regular employees in a company is often referred to merely as wages, as they are cash payments that are usually stripped of the additional employee benefits that remuneration includes.

- Say they pick up extra shifts during the holidays when the store gets busy and work 44 hours in one week.

There is no linkage between the amount paid and the number of hours worked. Someone receiving a salary is usually in a management or professional position. The wage based workers have to work daily to earn money for their livelihood and there is no paid leaves concept for daily wage earners. Whereas, the salaried employees can avail paid leaves, sick leaves, perks, etc. which is a huge benefit to the salaried employees. From the above discussion, it is evident that the wages and salaries are different and cater different needs of different people.

The Importance of Transaction Success Rate

In some circumstances this can make it more difficult to separate work and personal time. For example, a warehouse employee works 40 hours during the work week. If the employee’s hourly rate of pay is $15, on the 5th day following the work week, the employee will receive a paycheck showing gross wages of $600 (40 x $15). If the employee had worked only 30 hours during the work week, the paycheck will show gross wages of $450 (30 x $15).

- Some salaried employees can earn bonuses for overtime work, commission, or other work-related accomplishments or goals, but in general, a salaried employee’s total yearly compensation stays the same unless they get a raise.

- While salaries provide more stability and predictability, wages offer more flexibility in terms of hours worked.

- This means that employees can make more money if they work extra hours.

- Most seasonal and part-time positions pay a wage instead of a salary.

It has been shown by “unrebutted proofs, that the salary of petitioner Marta Avendaño was not sufficient for her expenses and that of her family. Under the Revised Rules, the following, among others, is declared exempt from execution. Obviously, the exemption under Rule 39 of the Rules of Court and Article 1708 of the New Civil Code is meant to favor only laboring men or women whose works are manual. Persons belonging to this class usually look to the reward of a day’s labor for immediate or present support, and such persons are more in need of the exemption than any other (Gaa vs. Court of Appeals, 140 SCRA 304). As the name itself suggests, this is a combination of a wage based on both piece work and time work. The combination of a fixed plus variable salary, as mentioned above, is known as a pay mix.

How Much Should I Spend on Salaries and Wages?

They usually have a set of responsibilities that they are expected to fulfill, regardless of how much time it takes. Though the OED links the two as interchangeable, there was always an alternate usage. The alternate use and the more recent definition for renumeration set it apart from its confused cousin. Since the 1500’s an alternate meaning of renumeration is listed as a verb; it is the action of numbering or renumbering something, or it can mean counting or recounting items.

The main advantage of wages is that they can vary depending on how much work a person does each week. This means that employees can make more money if they work extra hours. However, wages are considered much less reliable in the long term, and overtime pay is not always guaranteed. Ultimately, the difference between salary and wages comes down to dependability versus flexibility. The essential difference between a salary and wages is that a salaried person is paid a fixed amount per pay period and a wage earner is paid by the hour. Someone who is paid a salary is paid a fixed amount in each pay period, with the total of these fixed payments over a full year summing to the amount of the salary.

How Does Salary Pay Work?

Variable pay depends on the work carried out or on the targets met by the employee. This variable component is usually accompanied by a fixed base salary, which the employee will receive regardless of results. The content provided on accountingsuperpowers.com and accompanying courses is intended for educational and informational purposes only to help business owners understand general accounting issues. The content is not intended as advice for a specific accounting situation or as a substitute for professional advice from a licensed CPA.

- To figure out whether salary or hourly pay is right for you, consider these factors.

- Whether you’re job seeking or looking to renegotiate your current position, here’s what to know about being salaried versus earning an hourly wage.

- They can be based on experience and job performance, but are typically higher than wages for the same position.

- While people who make a Wage may earn overtime, there are a few disadvantages to the wage based payment structure.

- There is no linkage between the amount paid and the number of hours worked.

- If you take on managerial duties, for example, you’re probably exempt.

Read more about the differences between incentives and benefits here. While both Salaries and Wages put money in an Employees pocket and are similar, they are not quite the same. Both represent Employees getting paid for the work performed, but the underlying concept behind them is a bit different. Let’s take a deep dive into the pros and cons of each wage type to help you make your decision.

A refresher on health insurance terms

The term salary is the agreed upon amount of money between the employer and the employee that is extended at regular intervals on the basis of an individual’s performance. Salary is generally a fixed amount of package calculated on an annual basis. When divided by a number of months the amount to be disbursed monthly is ascertained.

Is salaries and wages expense on the balance sheet?

Salaries and Wages Payable go on the balance sheet as a part of liabilities under the current liabilities. Most Salaries and Wages are payable only within normal operating period or one year thus, making current liability.

So, for Nationals, pensions are not paid for only by employers, but also via employee deductions (and government contribution). There are very few mandated employer contributions or employee deductions. There might be healthcare, which is typically paid mostly by the employer.

Employees paid by the hour are eligible for overtime pay—their base wage plus 50%. A salary is a specific amount of compensation for work regardless of the number of hours worked. While some workers favor the security of a regular paycheck, others prefer knowing when they’ll clock out at the end of the day and delight in earning extra pay for working overtime hours. As such, they are often exempt from overtime pay regulations, meaning they don’t receive extra pay for working beyond the standard 40-hour work week.

- As of 2022, the average annual pay for salaried jobs in the U.S. is $54,132.

- The golden parachute is similar to the hello, but employees use it as an exit strategy.

- This amount is divided into equal parts that are paid out at regular intervals, usually biweekly or monthly.

- In view of the above, if “salary” is considered as the compensation earned by white collar workers, where it is presumed that they earn more than the wage earners, then their salary may not be immediately exempt from execution.

- The content is not intended as advice for a specific accounting situation or as a substitute for professional advice from a licensed CPA.

- While these two terms are often used interchangeably, there is a distinct difference between them that is important for any worker or employer to understand.

The wages are given daily, weekly or fortnightly and the compensation to be paid is determined by considering the hours worked by the person. Wages are paid to the blue-collar workers who involve in technical, manual and more of a physical work. Wages and salaries are two forms of remuneration used to compensate employees for their work.

Although salaried employees are guaranteed a fixed wage, a salary often comes with expectations that you’ll go “above and beyond” at your job. Depending on your field, this means you might find yourself grinding away well beyond the https://www.bookstime.com/ standard 40-hour work week. Direct costs are expenses that can be directly tied to the production of a specific good or service. These costs include labor costs for employees who are directly involved in the production process.

In other words, salaried employees receive their income regardless of the number of hours they work, whereas hourly workers’ pay is based solely on how many hours they clock in each week. Generally speaking, salaried jobs are more stable and secure than hourly jobs, as the income is much more consistent and reliable. Salaries are typically calculated https://www.bookstime.com/articles/salaries-and-wages on a yearly basis and can be divided into monthly, bi-weekly, or semi-monthly payments. They can be based on experience and job performance, but are typically higher than wages for the same position. Salaried workers are often expected to work the standard 40-hour week, but extra hours may be requested depending on job-related factors.

Salaried Employee Example

Those stationed in higher tier positions in management or at executive levels may have heftier remuneration packages that include even more benefits. Remember, to be remuneration, it has to translate to money in the employee’s pocket. Popcorn and pizza Friday isn’t a remuneration benefit, but a daily food allowance is. ‘Wage’ is the term which specifies the compensation paid to the person in return to the job he had done in the organization.

In the United States, for instance, non-exempt employees must receive one and a half times their regular pay rate for any hours worked beyond 40 in a work week, according to the Fair Labor Standards Act. Remuneration is a broad-based term that is meant to represent all the ways in which an employee is compensated for labor and his or her role within a company. This can include a variety of rewards from cash wages to sales commissions and bonuses for performance, stock options, expense accounts, and the use of company assets such as aircraft, cars, and housing.

L'articolo Salary vs Wages: Know The Difference Between Wages and Salary proviene da Ebike Italia.

]]>L'articolo Your Endowment Questions, Answered proviene da Ebike Italia.

]]>- While an endowment fund can help the organization reach these types of donors, it may inadvertently discourage the organization’s donors that give annually for operations.

- Many donors choose to name their fund with their or their family’s name or as a memorial to a loved one.

- An endowment is a donation of money or property to a nonprofit organization, which uses the resulting investment income for a specific purpose.

- Underwater endowments are required to be classified within net assets with donor restrictions.

- While colleges and universities with the largest endowments often garner attention, in our study, the median endowment was $203.4 million, and more than half of participating schools had endowments less than $250 million.

- From world class, culturally diverse performances to education and outreach, Dayton Contemporary Dance Company with support from the Foundation, is moving people and creating change through dance.

Making big contributions to endowments of elite institutions (like museums or private schools) is one way families seek to transfer status to their children. Heirs can gain standing in community institutions based on the contributions their family has made to these institutions. If you are one of these institutions, this is another motivation you can tap into to generate endowment. However, an endowment funds-to- operating-expense ratio is the one such “benchmark” at times sought by non-profit organizations—though there is no real justification or worthiness for such a number in any event. Managers of endowments have to deal with the push and pull of interests to make use of assets to forward their causes or sustainably grow their respective foundation, institution, or university.

Who does the endowment belong to?

An endowment-rich organization can be cash poor, with big assets and not enough additional money to run its programs. Private operating foundations must pay substantially all—85% or more—of their investment income. Many experts believe strong stock market returns have been inflated for the past seven years by low interest rates and the quantitative easing policies of global central banks. However, due to a number of factors — including current equity market valuations, current long-term interest rate levels and the likelihood that the U.S. Federal Reserve will have a more normalized interest rate policy in the future — many experts expect lower returns on stocks over the coming decade and weak returns for bonds and cash equivalents.

It could be two times, four times, etc. of the annual operating expense amount. Except in a few circumstances, the terms of endowments cannot be violated. Most endowment funds have the following three components, which govern investments, withdrawals, and use of the funds. In some cases, a certain percent of an endowment’s assets are allowed to be used each year so the amount withdrawn from the endowment could be a combination of interest income and principal.

North Carolina Passes Sweeping Tax Law Changes

After all these factors have been considered, the board of directors will play an important role in determining if the organization moves forward with an endowment. If it accepts or sets up the endowment, it will require educating management, the board, and future donors on an ongoing basis. Determine how much the organization needs to put into the endowment in order to reach its necessary spending goals. To do this, determine what percentage of the interest earned will be accessible to the organization each year, for example five percent. Then, determine how much money the endowment needs to have as principal in order to produce enough income for the organization’s needs. If the endowment needs to product 20 percent of the organization’s funding, for example, of the $1 million that the organization needs yearly, then the endowment needs a balance of at least $4 million to create the $200,000 necessary.

- Advocating for divestment from industries and countries that students find morally compromised is still prevalent among student activists, though the practice is evolving to improve efficacy, according to reporting by The New Yorker.

- You can stick your endowment in a money market account, but you’ll do better when you actively manage your money, or pay a professional to do it.

- This was an unofficial “suggested standard” which was not imposed on organizations in any way for them to receive grant consideration, nor was there any kind of measuring rationale made by the foundation regarding that ratio.

- Well, we should not overlook the generic “power of the ask”—endowment campaigns are visible community events that give donors a new reason to contribute to an organization that seems to be serious about planning for the future.

- The UPMIFA is designed to protect donors and organizations related to contributions and ensure the funds are managed efficiently.

- Management and the Board of Directors of the organization should think about the following considerations as they weigh the benefits and costs of establishing an endowment fund.

- Determine how much the organization needs to put into the endowment in order to reach its necessary spending goals.

Large endowments had been thought of as rainy-day funds for educational institutions, but during the Great Recession, many endowments cut their payouts. A 2014 study published in the American Economic Review looked closely at the incentives behind this behavior and found a trend toward an overemphasis on the health of an endowment rather than the institution as a whole. Endowments can also be established for specific disciplines, departments, or programs within universities. Smith College, for example, has an endowment for its botanical gardens, and Harvard University has more than 14,000 separate endowment funds. Once the board of the nonprofit agrees to the terms of the endowment, legal steps can be taken to set up the endowment. This process simply involves opening the account with a financial institution who will properly manage the funds and the investing.

Endowment Management

Organizations that are in the endowment game, however, reap the benefits of solidity and unrestricted income. An endowment can also be a very positive symbol that shows the community and potential donors that your organization is not a fly-by-night operation. It signals that yours is a flush organization that plans to be around for a very long time—this alone https://accounting-services.net/what-s-the-difference-between-amortization-and/ can bring large donations to your door. Reducing allocations to safer assets (such as investment-grade bonds) and into riskier assets (stocks), can increase a portfolio’s expected long-term return. More risk does not automatically yield higher returns (especially in the short term), but it increases the probability of higher returns over the long run.

But for most organizations without the alumni legacy power of places like Harvard, that’s probably not the right answer. Once you complete and sign your fund agreement, we will begin to serve your charitable objectives, assuring that your wishes will be met in perpetuity. We will send you and/or your advisor fund activity reports quarterly to help you keep track of your charitable fund and your grants made from it. Even when endowment values go down, it is possible for withdrawals to go up. Among the schools that participated in the 2022 NTSE, withdrawals increased to $25.85 billion in FY22 compared to $23.89 billion FY21. By signing up, you agree to our privacy policy and terms of use, and to receive messages from NPQ and our partners.

Endowment Calculator

” A good indicator that an organization is ready to establish an endowment fund is based on the annual revenue. Ideally, the annual donor revenue should be 110% or more of the annual operating budget to allow for organic growth. If revenue is around 110% of the annual operating budget, the organization should consider if it has adequate reserves.

Of the students who receive scholarships, 20% pay nothing to attend Harvard College. The oldest endowments still active today were established by King Henry VIII and his relatives. His grandmother, Countess of Richmond, established endowed chairs in divinity at both Oxford and Cambridge, while Henry VIII established professorships in a variety of disciplines at Oxford and Cambridge. Our administrative fees and investment policy provides further information. Start by contacting us to discuss your charitable or estate-planning goals. We will work directly with you and your financial advisor to customize a charitable plan that will help you enhance the quality of life in your community and offer you significant tax advantages.

How to Create a Fund

Organizations that can find a way to reduce their spending levels now will ultimately position themselves for a stronger future. It’s not unusual for student activists to look with a critical eye at where their colleges How Big Should Your Endowment Be? and universities invest their endowments. In 1977, Hampshire College divested from South African investments in protest of apartheid, a move that a large number of educational institutions in the United States followed.

- But for most organizations without the alumni legacy power of places like Harvard, that’s probably not the right answer.

- It could be two times, four times, etc. of the annual operating expense amount.

- The only way for a nonprofit to decide whether to pursue an endowment strategy is to fully educate your board of directors and have them hash it out.

- Gain access to our exclusive library of online courses led by thought leaders and educators providing contextualized information to help nonprofit practitioners make sense of changing conditions and improve infra-structure in their organizations.

- Our money will undergird a community institution long after we’re gone.

L'articolo Your Endowment Questions, Answered proviene da Ebike Italia.

]]>L'articolo Understanding the Difference Between Cash and Accrual Accounting Juna proviene da Ebike Italia.

]]>Likewise, you can show which bills your business has already paid and any expenses or liabilities that have yet to be dealt with. This method makes it easy to keep the unique situation of each sale or bill up to date, making adjustments when each item is satisfied or keeping notes of anything still outstanding. The single-entry system looks a little more like a personal bank account where amounts are credited or debited in one table or ledger. It can only be used with cash-basis accounting, not accrual accounting. But only the accrual basis is accepted by Generally Accepted Accounting Principles (GAAP), which is a set of rules established by the Financial Accounting Standards Board (FASB).

However, the reverse is more difficult—the IRS must approve a change from accrual accounting to cash accounting. For practices with large inventories of pre-purchased supplies, like oncology practices, special rules for accounting for inventory purchases and sales may apply. With accrual accounting, you will have less awareness of your cash flow. Your business may appear highly profitable even though its bank account is empty. Cash basis accounting is still a popular option, however, due to the simplicity of the overall process. Another reason to choose one over the other would be based on your sales revenue.

The Beginner’s Guide to Bookkeeping

Accrual-basis accounting requires more effort to understand, but it more accurately represents your business’s financial health over time. The cash method of accounting seems pretty logical until you consider that many business owners do all the work for a project months before getting paid. This will make it more challenging to manage your cash flow because it will not be clear what’s coming in and going out over the next few days, weeks, or months. Accrual-focused accounting tracks revenue as it is earned and expenses the moment they are incurred.

With the accrual method, you record revenues and expenses when they are generated, regardless of when the money is collected or paid. So, for example, you record income when you finish a project and issue an invoice, not when that invoice is paid. Companies generally account for incomings and outgoings using either of these 2 methods for tax filing and financial reporting. You can use 1 method for each—for example, accrual for tax and cash for financial reporting. You can even take a hybrid approach, providing it accurately reflects your income and is used consistently.

- We don’t guarantee that our suggestions will work best for each individual or business, so consider your unique needs when choosing products and services.

- It’s June 1st, and he’s been in business for several years and uses cash-based accounting.

- TempDev also offers staff augmentation services, including temporary revenue cycle managers and billers, to help with your revenue cycle needs if you need to get caught up from a transition.

- The literal definition of cash-basis accounting is the accounting system that recognizes cash when it is received and bills when they are paid.

They may base big financial decisions and things like loan applications on accrual accounting but use cash-basis accounting to simplify some elements of their tax. Speak to an accountant or tax professional to find out what applies to you. The difference between cash vs accrual accounting is when transactions are entered into the books.

Accrual vs Cash Accounting: The Basics

Accounting software and tools like QuickBooks Live can help with either method, with virtual accountants available to help you every step of the way. We offer a comprehensive range of outsourced bookkeeping services, from monthly bank statement reconciliation to managing cash transactions and ensuring the proper controls are in place. Recognizes revenue and expenses when earned or incurred, not when cash is exchanged. It’s now July, and Tim has accepted his need to change his business to accrual accounting due to the new vendor terms.

Businesses with less than $25 million in gross receipts do have a choice. For details on how to apply the gross receipt test, the IRS guidelines on acceptable accounting methods and how to change your accounting method, refer to IRS Publication 538. A company might look profitable in the long term but actually have a challenging, major cash shortage in the short term. For example, let’s say you do a job where the client will pay at a later date.

Cash basis accounting

There is a widely used style of accounting known as hybrid accounting or modified cash-basis accounting that combines aspects from both cash and accrual accounting. Knowing it is accrual-based accounting, we can extrapolate from the above statement a clearer picture of what occurred only during the reported month. Therefore we can now say with much more certainty that Tim’s Tasty Tornado is likely a profitable one. Because cash accounting only records when payments are made or received, a statement like the above will more closely align itself with the company’s cash flow statement than accrual accounting might. Without looking at a cash flow statement, we can say with certainty that there is $13,400 in Tim’s account, where he started with $10,000. Cash-based accounting is a method where revenues and expenses are only recognized when the cash exchanges hands.

The cash basis method of accounting only records transactions when the money is actually paid or received. Cash accounting is easier to implement and is often used by small business owners and individuals. Businesses using the cash basis of accounting can only accept cash, card, or check. They cannot have in-house financing, as that requires accounts receivable. Accounts receivable represents money that is owed to a firm but not yet paid. The business provided the good or service but has yet to receive the money for doing so.

Example of cash basis accounting

Under IFRS it is expected that businesses use the accrual method of accounting. Using the example from above, and applying the accrual basis of accounting, you would record the $1,000 as income in March’s bookkeeping versus in April when you actually received the funds. Because of its simplicity, many small businesses and sole proprietors use the cash basis method as their primary method of accounting. If your business makes less than $25 million in annual sales and does not sell merchandise directly to consumers, the cash basis method might be the best choice for you.

- The difference between cash and accrual accounting, the two types of accounting, is the timing of when transactions are recorded and when revenue is recognized.

- While simple and easy to maintain, the cash basis of accounting does not always show an accurate image of the true financial state of a business.

- The accrual-based profit would show $20,000 in May where cash basis would be in June.

- However, if you use accrual accounting, you record the income on your 2023 taxes because you count the revenue when it is invoiced, not paid.

- When you start out in business, you may not think which accounting method to use is an important decision.

This means that accrual accounting can be financially devastating to a small business – your books could show a large amount of revenue when your bank account is completely empty. Additionally, this method is actually required for businesses with sales revenue over 26 million dollars in a three-year period. Accrual accounting provides a more realistic financial view of a business over the long term and is especially helpful for companies with large amounts of inventory. Many businesses prefer cash-basis accounting for taxes because it can make it easier to maintain enough cash to pay taxes.

ITCHY pays its chemical supplier $50 for each tank of insecticide when it picks up the tank on the morning of each monthly spray. For example, under the cash basis method, retailers would look extremely profitable in Q4 as consumers buy for the holiday season. However, they’d look unprofitable in the next year’s Q1 as consumer spending declines following the holiday rush.

School Board Addresses $11 Million Budgeting Error – Burbank … – OutlookNewspapers.com

School Board Addresses $11 Million Budgeting Error – Burbank ….

Posted: Wed, 21 Jun 2023 14:26:00 GMT [source]

Accrual basis accounting provides a more accurate picture of a business’s financial position than cash basis accounting because it reflects current and future financial obligations. This method allows for better financial planning and forecasting, enabling companies to track their revenue and expenses in real-time. Cash basis accounting is a method of bookkeeping average growth rate for startups in which a company records its financial transactions when cash is paid out or received. It is a simple accounting method ideal for small businesses with a low volume of transactions and does not require complex financial reports. Cash-basis accounting is the easier of the two methods because, as its name implies, all bookkeeping simply follows the cash.

Businesses that hold large amounts of inventory also benefit from accrual accounting. In general, the greater the lag in conversion to cash from sales, the stronger the argument for accrual-based accounting. The accrual basis of accounting is the gold standard because it gives a more accurate representation of a company’s finances. With accrual accounting, businesses can more easily keep track of credit transactions using an accounts receivable system, which shows the full transaction history of each customer. An accounts payable system shows the transaction history between your company and a vendor or supplier.

Most other businesses, especially midsize businesses and large corporations, use accrual accounting. If you sell services rather than goods, you might have the choice between the two methods. Accounting software like Xero and QuickBooks Online let you choose your preferred accounting method during the setup process. Since accrual accounting shows these details, most business owners will choose to switch to accrual accounting at some point within the business lifecycle.

L'articolo Understanding the Difference Between Cash and Accrual Accounting Juna proviene da Ebike Italia.

]]>L'articolo Vertical Analysis of Income Statement Advantages and Disadvantages proviene da Ebike Italia.

]]>Content

- Connect live QuickBooks reports to Google Sheets

- Horizontal Company Financial Statement Analysis

- Vertical Analysis

- Vertical vs horizontal analysis

- Common Size Analysis of Financial Statements

- Gather Data

You will also learn how to carry out vertical analysis using both an income statement and a balance sheet. You can analyze financial statements using multiple methods, including horizontal and vertical analysis. Horizontal analysis studies changes to variables over time, using historical data to predict future trends. Vertical analysis, however, studies the proportions of the total amount represented by the different variables during a single period. This type of analysis can be used to identify trends and areas of improvement on a company’s financial statements.

- For example, in 2012, Current Assets are 36% of Total Assets for that year; whereas, in 2014, Current Assets are 56% of Total Assets.

- Likewise, a large change in dollar amount might result in only a small percentage change which will not cause concern for the business owner.

- Common-size analysis is also an effective way of comparing two companies with different levels of revenues and assets.

- You can also use vertical analysis to compare different companies in the same industry.

- For example, an Assets to Sales ratio is a measure of a firm’s productive use of Assets.

- This type of analysis can be used to identify trends and areas of improvement on a company’s financial statements.

They can then use this information to make business decisions such as preparing the budget, cutting costs, increasing revenues, or investments in property plant or equipment. This means Mistborn Trading saw an increase of $20,000 in revenue in the current year as compared to the prior year, which was a 20% increase. The same dollar change and percentage change calculations would be used for the income statement line items as well as the balance sheet line https://www.bookstime.com/ items. The figure below shows the complete horizontal analysis of the income statement and balance sheet for Mistborn Trading. Vertical analysis uses percentages in its analysis, restating either income statement or balance sheet items as a percentage. For example, if you’re using vertical analysis with a balance sheet to analyze your assets, your base amount would be your total assets, with each individual item given a percentage in the next column.

Connect live QuickBooks reports to Google Sheets

While performing a vertical analysis, every line item on a financial statement is entered as a percentage of another item. For example, on an income statement, every line item is stated in terms of the percentage of gross sales. Vertical analysis is the proportional analysis of a financial statement, where each line item on a financial statement is listed as a percentage of another item. This means that every line item on an income statement is stated as a percentage of gross sales, while every line item on a balance sheet is stated as a percentage of total assets. The primary disadvantage of vertical analysis is that it does not provide an absolute measure of performance. By expressing each item relative to the base figure, vertical analysis does not provide an accurate indication of absolute performance levels.

For example, on an income statement, the value of each revenue stream is a separate line item, which contributes to the total revenue. An example of vertical analysis would be if you took a company’s total revenue and divided it by the number of products they sell. This would give you an idea of how much each product contributes to the company’s overall revenue. To complete a vertical analysis for your balance sheet, you’ll need to perform this calculation for each line item that is currently listed on your balance sheet.

Horizontal Company Financial Statement Analysis

We’ve now completed our vertical analysis for our company’s income statement and will move on to the balance sheet. So if we had multiple years of historical data, it is recommended to organize the percentage calculations into a single section on the far right or below the financials with the timing of the periods aligned. Again, keep in mind that these examples only become an issue if they occur consistently over several accounting periods, which is why it’s so important to perform vertical analysis regularly.

This could be useful in identifying areas where a company may be over- or under-invested. Management sets a base amount or benchmark goal to judge the success of the business. The base amount is usually taken from an aggregated from the same year’s financial statements. The common-size percentage formula is calculated by dividing the analyzed item by the base amount of benchmark and multiplying it by 100.

Vertical Analysis

For instance, if a most recent year amount was three times as large as the base year, the most recent year will be presented as 300. If the previous year’s amount was twice the amount of the base year, it will be presented as 200. https://www.bookstime.com/articles/vertical-analysis Seeing the horizontal analysis of every item allows you to more easily see the trends. It will be easy to detect that over the years the cost of goods sold has been increasing at a faster pace than the company’s net sales.

How is vertical analysis used?

Vertical analysis breaks down your financial statements line-by-line to give you a clear picture of the day-to-day activity on your company accounts. It uses a base figure for comparison and works out each transaction recorded in your books as a percentage of that figure.

L'articolo Vertical Analysis of Income Statement Advantages and Disadvantages proviene da Ebike Italia.

]]>L'articolo Top 15 Bookkeeping Software for Startups proviene da Ebike Italia.

]]>Content

- Maintain key financial statements

- Income statement:

- Know your lead time.

- Bookkeeping, tax, & tax credits for startups.

- Online Bookkeeping Classes

Most startup accounting also involves organizing separate ledgers for assets, liabilities, revenue, and expenses. With the creation of your startup, it is easy to get caught up in product promotion excitement. Proper bookkeeping and accounting will help you ensure that your sprouting business has the funds necessary to succeed. The simplest type of accounting for your tax return is cash basis accounting. Cash basis will track income when it is received and expenses when they payout.

Accounting is deciphering your financial records for everything from paying the right taxes to strategic business decision making. While bookkeeping is there to ensure the process of tracking all financial records https://www.apzomedia.com/bookkeeping-startups-perfect-way-boost-financial-planning/ is complete. LedgersOnline understands that starting your own business can be overwhelming, and cash flow can be a big concern, so our expert bookkeeping services are designed to help make the journey easier.

Maintain key financial statements

Finally, if the bookkeeper consistently misses deadlines or is otherwise unreliable, it may be time to find someone else to handle the books. By keeping an eye out for these warning signs, businesses can avoid hiring the wrong startup bookkeeper. Good recordkeeping is essential for any business, but it is especially bookkeeping for startups important for businesses that are required to file taxes. Make sure you keep track of all of your income and expenses so that you can accurately report them on your tax return. As a startup, you will need to track your finances and prepare financial statements to present to investors and business partners.

She is a former Google Tech Entrepreneur and she holds an MSc in International Marketing from Edinburgh Napier University. As a business owner, you have many options for paying yourself, but each comes with tax implications. With a little knowledge, you’ll be certain to select the right bookkeeping option for your startup. “It’s your livelihood on the line, not your bookkeeper’s,” says Williams.

Income statement:

If you can’t make a home office work, look into virtual office spaces or office sharing. Typically, these spaces include a mailing address, local telephone number, receptionist to answer calls, physical office space, and access to a conference room that you can rent by the hour. You can create a dropbox for each client, and they can start submitting their information. This system is much more secure than sending files via email or flash drive. To access the information in the document-sharing program, you need a user ID and password.

L'articolo Top 15 Bookkeeping Software for Startups proviene da Ebike Italia.

]]>L'articolo Billable Hours TV Series 2006 2008 proviene da Ebike Italia.

]]>Content

- Software that can help your track billable hours

- Bill clients

- Calculate Your Total Billable Hours

- Best practices for billable hours

- Why Use a Law Firm Billable Hours Chart

- Resources for Your Growing Business

It’s easy to forget to record your daily project-related and billable tasks. Many small businesses use a monthly invoice schedule and send out their invoices at the end of each month. Other companies invoice their clients twice a month, based on the volume of work tasks. Your https://www.bookstime.com/articles/prepaid-insurance-definition-and-examples target doesn’t have to be a fixed fee and can alternate from client to client. Both billable and non-billable hours should be treated like a precious resource and tracked and scheduled accordingly. You calculate utilization by dividing the total hours worked during the year by billable time.

I did this for a period of time, but I quickly realized it was duplicative to enter my time into a chart and then enter it again into our billing software. But whether you will enter your hours directly into your software or into your own chart really depends on the user-friendliness and accessibility of your employer’s billing software. You can print the attorney billable hours chart and keep it near your desk, or bookmark this webpage and return to it whenever you need.

Software that can help your track billable hours

There are many software options out there, designed to aid resource and practice management. This software not only helps offices keep track of billable hours, but also makes other useful tasks easier, like productivity analysis, costing, reports, invoicing, and accounting. It can be difficult for lawyers, consultants, accountants, and other professionals who combine billable and non-billable time to keep track.

Related articles on how to run a more efficient, profitable law firm. The Albanese government has pledged to cut its spending on consultants and contractors by $3.1 billion over the next four years. KPMG charged for work never completed and even billed for a consultant who had not worked on a project, they added. The whistleblower said while they worked for Defence, repeated financial errors favouring KPMG were discovered and the firm agreed to cut its fees. That prompted the whistleblower to audit KPMG’s earlier invoices. We’re here 24 hours a day, every day of the week, including holidays.

Bill clients

No matter the type of your industry, be sure to accumulate enough billable hours because they’ll cover your non-billables. Ideally, you should have more billable than non-billable hours. If a significant amount of your time is spent on non-billable tasks, you may no longer be very productive. So, if anything urgent needs to be addressed, you can see to it right away.

- For example, Jane is currently working on an administrative project for Client A when Client B calls her, frantic because her computer crashed and she can’t enter her payroll.

- Many firms expect attorneys to reach minimum billable hour requirements ranging between 1,700 and 2,300 hours per year.

- But, there’s also a certain weakness of a utilization rate system, especially applicable to consulting businesses.

- They spend their days trying to waste time and amuse themselves, often at the expense of their friends or themselves.

- So, in the PR industry, the utilization rate depends on position within the business.

Liam Martin is a co-founder of Time Doctor which is software to improve productivity and help keep track and know what your team is working on, even when working from home. By default, Time Doctor shows you all the work time tracked by a user as billable or payable. If no response is registered within 60 seconds of showing the pop-up, the time tracker stops on its own. You can run an online report to see how much money you’ve earned. When the time comes, export the report as PDF, Excel, or CSV, or share a link to the report with your client.

Calculate Your Total Billable Hours

Administrators of law firms should track both realization rates and utilization rate of employees. In addition, there should be a monthly report that makes a comparison between the billable hours that are recorded, and fees collected. In general, when lawyers have less than 100 percent of their billable hours, this could be an indicator of a problem.

Typically, employees are expected to have billable hours equivalent to at least three times their salaries. You can use a productivity management solution like Time Doctor to track your billable hours and create an invoice effortlessly. When clients can see the details of the work done on their case, in clear, simple, language, there is less confusion and fewer disputes over billing. Once you have a salary in mind, divide it by the number of working hours in a year, which is 2,080 hours for a full-time job.

Best practices for billable hours

Clockify is a time tracker and timesheet app that lets you track work hours across projects. While you can use manual methods to track and calculate billable hours, they can be inaccurate and unreliable. In this article, we’ll explore everything you should know about calculating your billable hours. We’ll also highlight the best tool you can use to calculate your billable hours accurately. More importantly, you have to ensure that you accurately track the time spent on projects and bill clients accordingly.

- By knowing exactly which tasks constitute billable hours and how to keep track, you’ll be ready and set to optimize everything from workflows to invoicing.

- The term, “billable hours” can sometimes cause confusion because people in many different professions charge for their work through invoicing.

- It’s called the realization rate – how many hours an attorney tracks compared to the fees that are collected.

- That said, there are many reasons attorneys might choose to create their own chart.

- Of course there are many professional tools for you, but here I will guide you to create a billable hour table in Excel, and save it as an Excel template easily.

- At the end of each billing cycle or when you complete a client’s project, review your time log and calculate your total billable hours for the project.

After all, your time is valuable, and every minute spent on billable hours will help you scale and increase your business’ profitability. You may even realize you need to hire an extra employee, a virtual assistant, or turn to specific software to automate some of these non-billable tasks. When you track every minute you spend on a project, you may be surprised to learn just how many tasks constitute your billable hours. While this sounds like a chore, all of these little inclusions will add up throughout a project.

L'articolo Billable Hours TV Series 2006 2008 proviene da Ebike Italia.

]]>L'articolo The Fed Chapter 3 Property and Equipment proviene da Ebike Italia.

]]>Content

- What Is an Asset? Types & Examples in …

- Characteristics of Fixed Assets

- Depreciation of Tangible Assets

- Are Supplies a Current Asset? How to Classify Office Supplies on Financial Statements

- What is Fixed Asset Accounting? Dynamics 365 Business Central

- FF&E (Furniture, Fixtures & Equipment): Definition

Depreciation is defined as the accounting process of allocating the cost of tangible assets to current expense in a systematic and rational manner in those periods expected to benefit from the use of the asset. Depreciation is an occupancy or usage cost and therefore, should begin the month following the date equipment is placed into production. Any adjustments for over or under estimates of depreciation, as may be determined when the Construction account is closed and final figures for Building and Equipment are capitalized, should be adjusted to current expense in the current month. Equipment with a cost of $10,000 or more must be capitalized using the individual asset method. Equipment with a purchase cost below $10,000 should be expensed. Record here in separate subdivisions for each class and series of capital stock issued, the excess of the par or stated value over the cash value of consideration received, less accrued dividends.

Record here all accounts payable within one year which are not provided for in accounts 2000 to 2021, inclusive. Record here all accounts payable within one year which accrued from generally recognized trade practices. Property and equipment of all types and classes used in storing and distributing fuel, oil and water, such as fueling trucks, tanks, pipelines, etc. Accruals shall be made to this account when allowances are established for losses in the value of expendable parts. The accruals to this account shall be made by charges to profit and loss account 73 Provisions for Obsolescence and Deterioration – Expendable Parts.

What Is an Asset? Types & Examples in …

Spare items shall be carried in balance sheet account 1300 Spare Parts and Supplies and shall be charged directly to expense upon withdrawal from stock for replacing original complements. Record here prepayments of obligations which if not paid in advance would require the expenditure of working capital within one year, such as prepaid rent, insurance, taxes, interest, etc. Unexpired insurance and miscellaneous prepayments applicable to periods extending beyond one year where significant in amount shall be charged to balance sheet account 1820 Long-Term Prepayments.

This account shall also include balances of contributions to the business enterprise of individual proprietors or partners. Fixed assets are expensive but important assets for most businesses — they help to keep the business running. But fixed assets have various specific accounting requirements as well. Fixed asset management software, such as NetSuite Fixed Assets Management, eliminates the hassle of managing fixed assets using manual spreadsheets. Having a complete, automated inventory of every fixed asset, large or small, and linking it with its historical cost and depreciation schedule, helps physically safeguard those assets and streamline accounting for them.

Characteristics of Fixed Assets

To understand the financial health of your business, you need to… Julie Thompson is a professional content writer who has worked with a diverse group of professional clients, including online agencies, tech startups and global entrepreneurs. Julie has also written articles covering Are Supplies A Current Asset? How To Classify Office Supplies On Financial Statements current business trends, compliance, and finance. Supplies for making, shipping, and packaging products are counted as inventory and are part of theCost of Goods Soldcalculation. At the end of a year, an inventory is taken of these supplies as part of this calculation.

- When disposing of assets the gross asset value and the related accumulated depreciation should be deducted from the appropriate asset account and from the allowance for depreciation account.

- This account is used to record costs of acquiring or constructing a building to be used by the Bank.

- Proper management of supplies is crucial to ensure that they are available when needed, that they are used efficiently, and that costs are minimized.

All other paragraphs in this chapter relate to the individual asset accounting method. Maximum useful lives for furniture and equipment asset groupings under both the individual asset and pooled asset method are found in table 30.78. This account is used to record costs of acquiring or constructing a building to be used by the Bank.

Depreciation of Tangible Assets

Also record here in separate subaccounts the costs of airframes overhauls accounted for on a deferral and amortization basis. Office equipment, desks and tables are considered fixed assets, as are fixtures such as sinks, cubicle walls or rugs (that is, any built-in item that cannot be removed without damage to the asset). Fixed assets tend to be high value items and, thus, represent a significant part of a company’s overall value. The more fixed assets a company has, the higher its valuation may be to investment, merger and acquisition partners. This is especially true in industries that are very asset-intensive, such as manufacturing, where the ratio of fixed assets to total assets is high. Companies of all sizes and industries have assets — items they control that bring current and future benefit to their business.

How would office supplies appear on a classified balance sheet?

Office Supplies are classified as current assets.

However, the purchase method alone doesn’t prove their use as a business expense. Supplies refer to items that businesses use in the course of their daily operations. These items are often used by businesses to drive revenue or by their employees to perform their daily tasks. This means supplies are items that are purchased to be used within a specified time frame. The cost may be considered immaterial if it does not significantly impact any financial statements.

Furniture and Fittings Definition Law Insider

Accordingly, as was noted from the following instructions, once a pool account had been established, the amount in the pool account remains unchanged for as long as the pool account remains in existence . Any furniture, furnishings, and fixtures purchased in 2021 will use the individual asset method of capitalization. Like other fixed assets, land is capitalized on the balance sheet.

Beginning in 2021, furniture, furnishings, and fixtures will have a capitalization threshold applied to the individual asset level rather than a pooled method. In addition to purchased furniture, a Reserve Bank may, at its option, capitalize and depreciate salaries and the outside cost of materials that are consumed in the https://kelleysbookkeeping.com/ construction of furniture and equipment by Reserve Bank personnel. These costs are capitalized and depreciated using the individual asset method. In practice, ensuring accounting consistency for large improvement projects became burdensome, especially as some buildings approached the end of their initial useful lives.

L'articolo The Fed Chapter 3 Property and Equipment proviene da Ebike Italia.

]]>